B1 GRAPH: Actuarial Modeling

to support cash flow projections for insurance companies and private pension funds

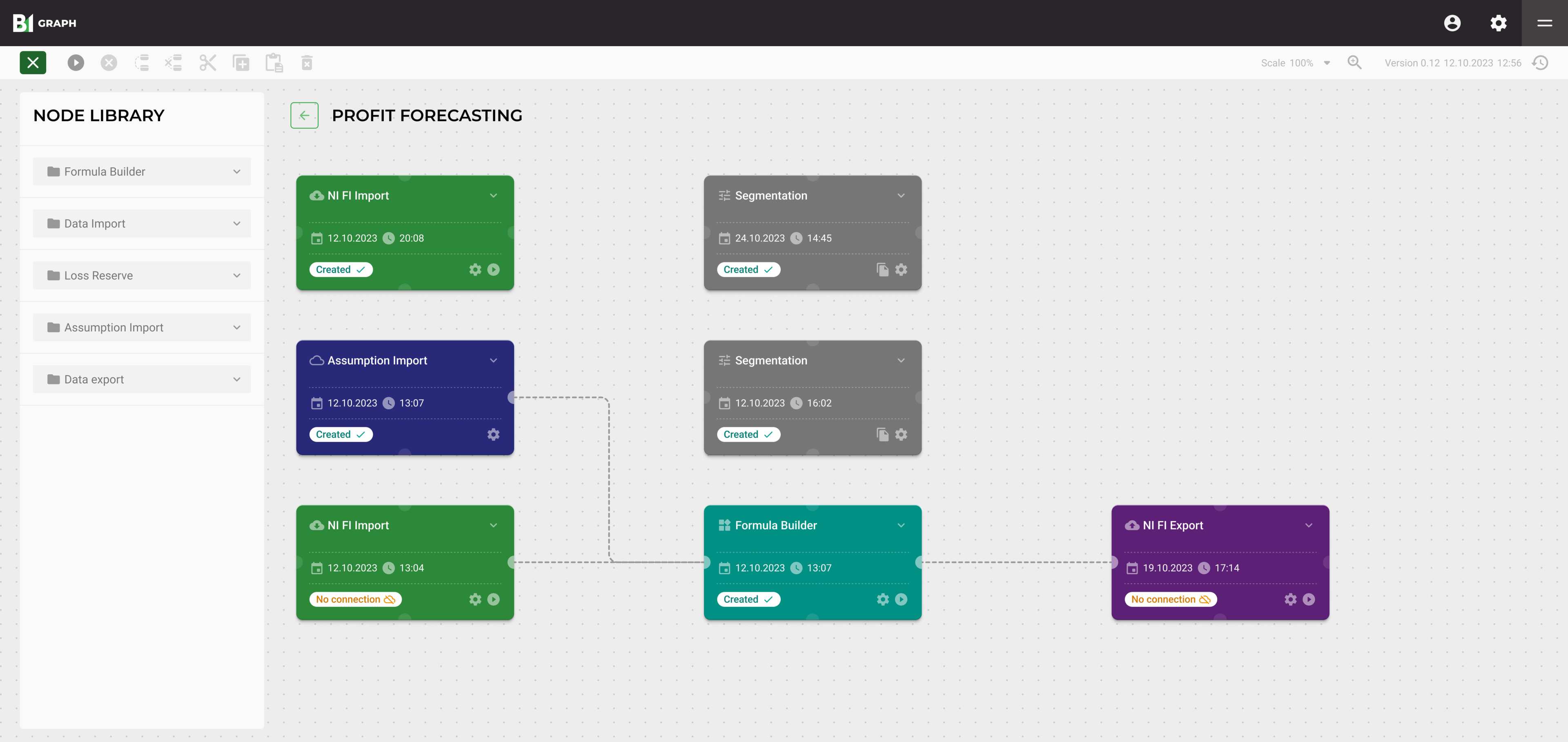

B1 GRAPH (B1 Graph Mathematical Computation Tool) is a powerful cross-industry platform designed to perform large-scale computations in minimum time. It became the basis for B1 GRAPH: Actuarial modeling, an industry-focused cash flow forecasting and loss reserving solution for insurance companies and private pension funds (PPFs).

FAST IMPLEMENTATION

01-3 months, with pre-configured actuarial models

HIGH CAPACITY

02,2 trillion metrics calculated in 3.5 hours (8.7 million contracts and 1,200 periods)

HIGH SPEED

0twice as fast as comparable systems

Business Lines

-

General insurance

-

Life insurance

-

Mandatory pension insurance

-

Private pension schemes

B1 GRAPH: Actuarial Modeling allows to:

-

Meet requirements for use of localized software and not be dependent on imported software

-

Automate cash flow actuarial valuation and predictive modeling to meet the needs of insurance companies and PPFs and the Bank of Russia’s requirements

-

Compute comprehensive, highly granular estimates and dramatically reduce reporting times

-

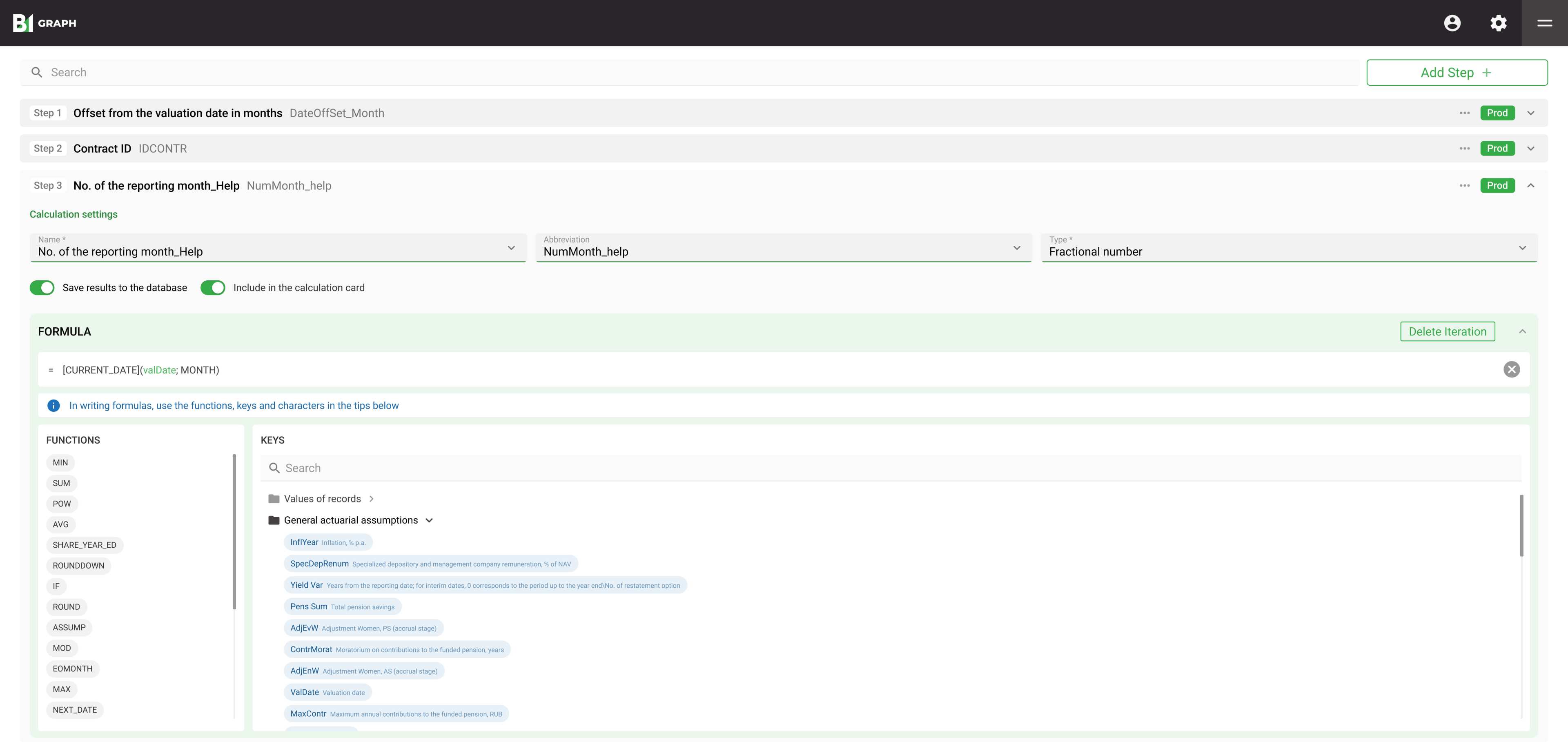

Create and modify estimation models without having to learn programming languages by using a formula builder with an embedded math function library

-

Integrate directly with source systems (a built-in ETL tool)

-

Customize your input data structure (a visual tuning feature)

-

Export outputs to a BI analytics tool or use the solution’s embedded reporting

-

Create a transparent modeling process for users and auditors

-

Flexibly manage access rights and master models

-

Group your projects by period of analysis and business unit

-

Manage contractual changes

-

Extend functionality and use the B1 GRAPH platform to address other business needs

FUNCTIONALITY

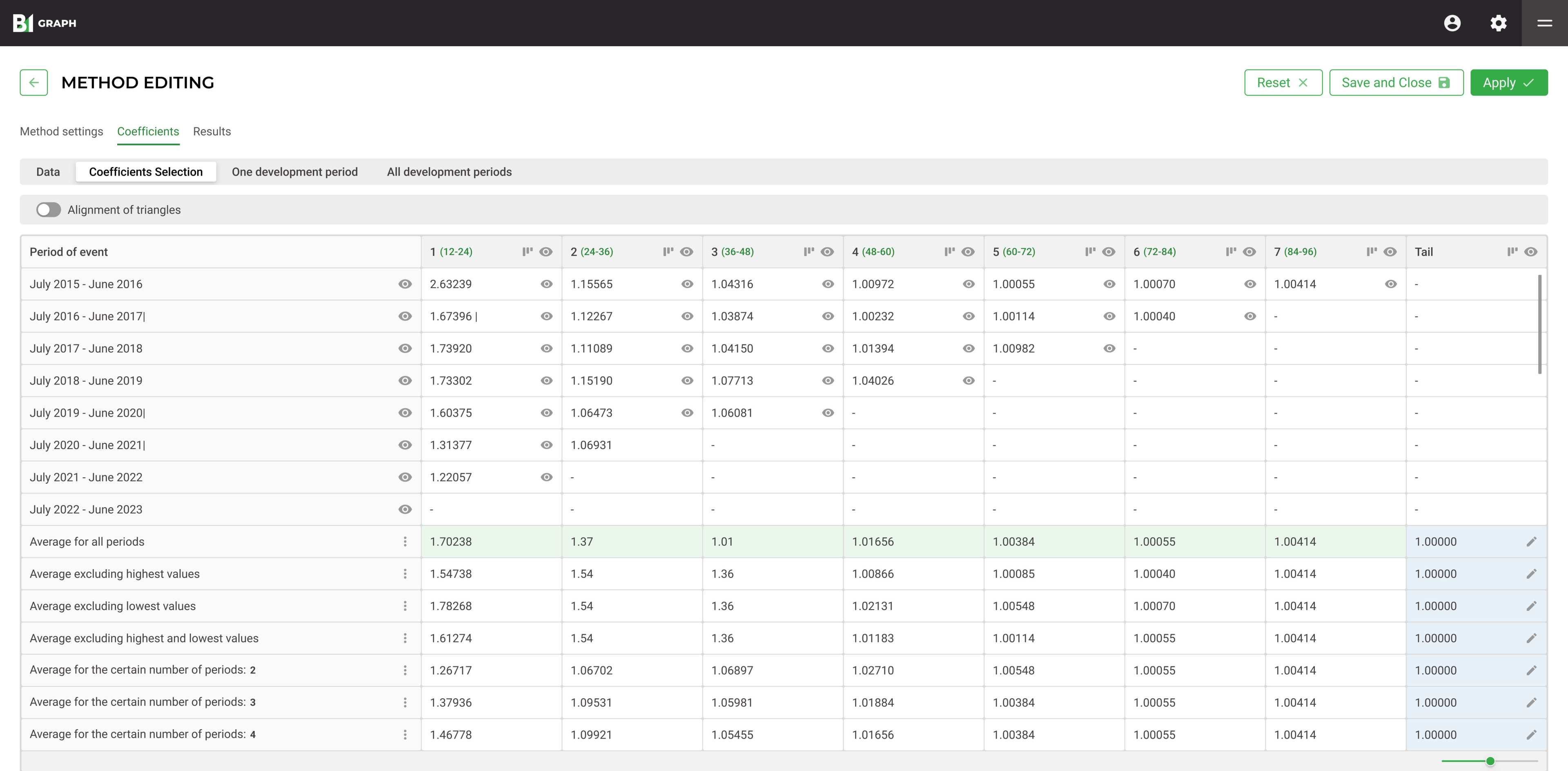

GENERAL INSURANCE

Loss reserve cash flow estimates can use deterministic and stochastic methods, including:

- Chain ladder

- Bornhuetter-Ferguson

- Frequency and severity

- Independent increments

- Bootstrap

- Naïve loss ratio

- Cape Cod

All of these methods allow for alternative actuarial assumptions (i.e., various methods can be used to select development factors and other parameters).

The system will automatically group computation outputs into cohorts as required by IFRS 17 and incorporate them into cash flow projections.

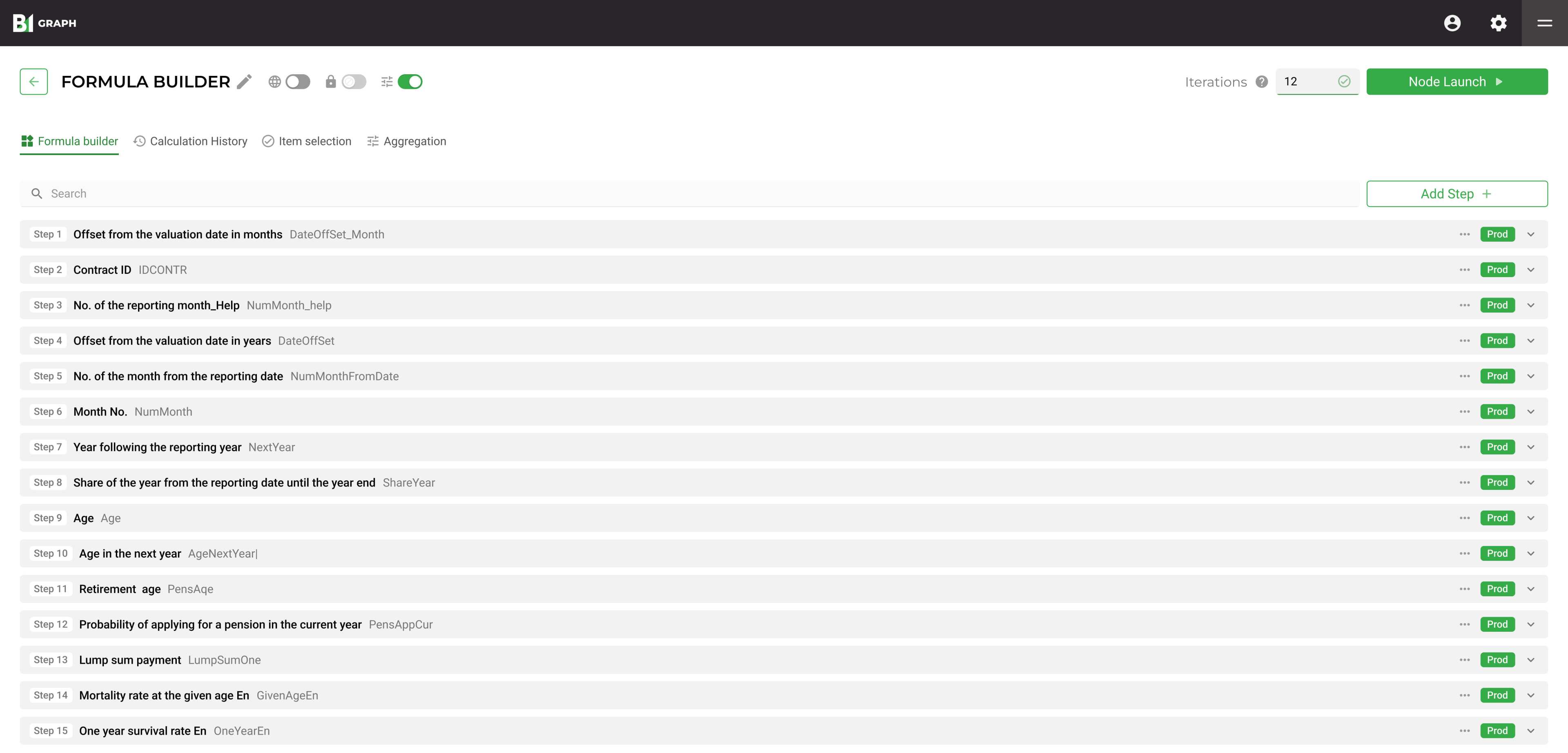

LIFE INSURANCE

Using the formula builder in premium reserve cash flow projections:

- Future earned premium calculation under the pro rata temporis and fraction methods

- A sequence of steps and pre-configured functions to help you build your cash flow forecasts

- Option to choose the forecast horizon

- Simple and transparent interface to modify actuarial assumptions and customize the standard computational model

- Option to use the assumptions derived from loss reserve estimates

PENSION PROVISION

For PPFs, the model takes into account the following cash flows:

- Pension contributions from members/investors or from the insured

- Earmarked contributions from corporate investors

- Redemption sums / transfers to other PPFs resulting from termination of contracts by members or the insured

- Death benefit payments to the insured’s heirs / successors

- Routine retirement benefit or lump sum payments

- Contract administration costs

- Management company, depositary / custodian and deposit insurance agency fee

IT PLATFORM

Architecture-wise, B1 GRAPH: Actuarial Modeling is designed to ensure immunity to sanctions, high productivity and security of information.

- The computational core operates on a high-performance DAG-based technology stack.

- For high-speed performance, formulas are encoded as mathematical structures, so only parameter values need to be input during computation.

- The application supports complex and DAG-based iterative computations, eliminating the need for a distributed computing environment on multiple servers.

- ClickHouse database delivers blazing-fast data reading to keep computation times to a minimum.

“The B1 GRAPH architecture is designed to support high-speed computations with moderate server requirements. With B1 GRAPH, for example, a server running on a 64-core processor with 128 GB storage space will process 2.2 trillion parameters in just 3.5 hours – twice as fast as specialized Western benchmark systems. By comparison, with Excel or Access, the same computation would take up to several days to complete.”

Andrei Kouzmine

B1 Partner, Consulting, Technology and Transactions Leader

.jpg)

IMPORT SUBSTITUTION

The B1 GRAPH (B1 Graph Mathematical Computation Builder) platform is registered in the unified register of Russian software (entry No. 20267 of 27 November 2023).

In terms of functionality and performance, B1 GRAPH: Actuarial Modeling competes successfully with both dedicated Western platforms (ResQ, Addactis, SAS, etc.) and domestic Excel-, Access-, Python-, MS SQL- and C#-based solutions.

DELIVERY OPTIONS

- On-prem (integration into your company’s existing environment)

- Cloud (on a rented server or cloud-delivered by B1)

- Hybrid (cybersecurity, unparalleled speed and cloud-powered efficiency combined)

Out-of-the-box solution

In just 1 to 3 months, you get a powerful tool with a wide range of pre-built features and functions

.jpg)

Flexible implementation

Integration into source systems combined with a standard configuration adapted to your company’s needs (6 months or longer to complete)

.jpg)

GROWTH POTENTIAL

As a powerful cross-industry platform, B1 GRAPH is poised to address any big data computational task – from financial planning, budgeting and pricing to internal reporting and much more. It features flexible and customizable computational models to suit any industry and requires no knowledge of programing languages.

(1) (1).jpg)