Tax Messenger

The advertising duty: detailed calculation and payment rules proposed

28.03.2025

The provisions of Federal Law No. 479-FZ of 26.12.2024, which introduced a duty on income received for the provision of Internet advertising services (“the advertising duty”), take effect from 1 April 2025. However, the law does not fully address the mechanisms for the calculation and payment of the advertising duty or for monitoring the correct and timely payment of the duty. A detailed summary of the provisions of the law was presented in a previous alert.

On 26 March 2025 the Russian Ministry for Digital Development published a draft decree of the Russian Government “Concerning Approval of Special Considerations Relating to the Calculation and Payment of Mandatory Charges Provided for in Part 1 of Article 18.2 of the Federal Law “Concerning Advertising” and the Procedure for Monitoring the Correct and Timely Payment of Such Charges” (“the Draft Decree”).

The purpose of the Draft Decree is to flesh out the rules for the calculation and payment of the advertising duty and lay down procedures for monitoring the timely payment of the duty by market participants.

The Draft Decree is currently undergoing an anti-corruption review stage (scheduled to end on 1 April 2025) and a public consultation stage (scheduled to end on 15 April 2025). Once the Draft Decree has been approved, its provisions will take effect from its publication date, but not earlier than 1 April 2025.

Overview of key provisions of the Draft Decree

Payers of the advertising duty are advertising distributors, advertising system operators, intermediaries and agents which:

- have concluded an agreement with an advertiser or

- have entered into an agreement with an agent that has an existing agreement with an advertiser or other agents..

The main principle is that there is one payer in the service delivery chain:

- If the advertising duty is paid by one of the participants in the contractual chain that work directly with the advertiser, such as an advertising distributor / an advertising system operator / an intermediary, then the other participants in the contractual chain do not pay.

If the advertising duty is paid by an agent, it pays the duty only on its own agency fee. However, the advertising distributor / advertising system operator / other intermediaries remain liable to pay the duty. In this case, the question remains of how, in a contractual chain in which agents are involved, the duty is to be paid by other participants in the chain that work directly with the advertiser.

However, an agent has the right to pay the advertising duty in full, in which case all the other participants in the contractual chain are exempt from paying the duty.

Thus, the approach to the payment of the advertising duty in relation to each item of distributed advertising depends on the contractual chain and the choice of payer made by the transacting parties.

The base for the calculation of the advertising duty at the rate of 3% is calculated on the following amounts:

- income received by advertising distributors, advertising system operators and intermediaries from Internet advertising services provided under an agreement with an advertiser;

- income of agents that act on behalf of and at the expense of an advertiser and/or an advertising distributor for the performance of an agreement concluded with an advertiser.

Importantly, reported income from the distribution of Internet advertising must be corroborated by account books, service completion certificates and primary documents of the payers of the advertising duty.

Time limits and procedure for the calculation and payment of the advertising duty

The payment period is each quarter running from the beginning of the calendar year.

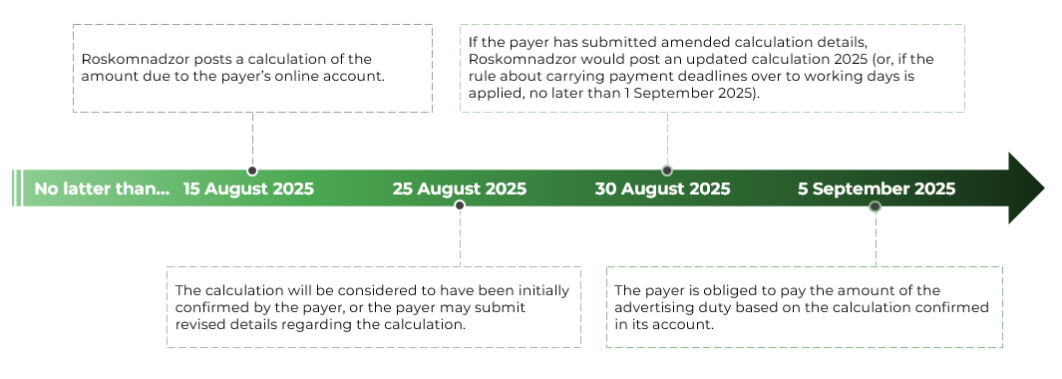

No later than the 15th of the second month of the quarter following a payment period, a calculation of the advertising duty payable for the relevant quarter will be generated in the payer’s account on the official website of Roskomnadzor (the Federal Service for Supervision of Communications, Information Technology and Mass Media). That calculation must be checked and confirmed by the payer within 10 calendar days by means of signing it in the account by an enhanced qualified signature or a simple electronic signature.

In addition, the payer has the right to send Roskomnadzor amended calculation details within the same 10 calendar days. Based on the amended details received from the payer, Roskomnadzor would, within 5 calendar days of receiving the amended details, post an updated calculation to the payer’s account. The payer must in turn calculate and confirm that calculation within 10 calendar days of receiving the updated calculation by signing it in the account.

If the payer does not confirm the calculation or submit amended details, the calculation will be automatically considered to have been accepted and confirmed by the payer upon the lapse of 10 calendar days from the date on which it was posted to the account.

The obligation to pay the advertising duty based on the calculation submitted by Roskomnadzor must be fulfilled no later than the 5th of the third month of the quarter following the payment period.

Once Roskomnadzor receives information that payment has been received, it must send a notification of payment to the payer within 1 working day.

Funds paid in excess may be refunded or credited towards future payments through an application to Roskomnadzor.

Thus, taking the second quarter of 2025 as an example, the procedure for the payment of the advertising duty would be as follows:

The procedure for the payment of the advertising duty

Monitoring and verification of the fulfilment of obligations to pay the advertising duty

The timely payment of the advertising duty will be continuously monitored by Roskomnadzor on the basis of information received from duty payers and information on payments obtained from the State Information System for State and Municipal Payments. In this regard, monitoring would be conducted without direct interaction with advertising duty payers.

No later than the 20th of the month preceding the year for which monitoring is to be conducted (i.e., no later than 20 December), Roskomnadzor must submit a monitoring plan to the Russian Ministry for Digital Development. The plan should outline the purpose, timeframes, payer categories, the monitoring deadline, and the procedure for submitting the monitoring results report.

After the end of a monitoring period (i.e., a year) and no later than the 20th of the month preceding the following year (i.e., no later than 20 December), Roskomnadzor must submit to the Russian Ministry for Digital Development a monitoring report containing lists of payers / non-payers of the advertising duty.

If, in the course of monitoring, Roskomnadzor identifies cases of the non-payment / underpayment of the advertising duty, the payer will be notified of the identified violation and its right to provide an explanation for that violation no later than 7 working days from the date of receipt of the notification of the violation. If Roskomnadzor does not accept the payer’s explanation or the payer does not provide one, Roskomnadzor will issue a demand for the payment of advertising duty. If the payer does not settle the advertising duty within 10 calendar days, the amount in question will be collected through court proceedings.

Thus, the process outlined above for monitoring the timely payment of the advertising duty is established to ensure the full payment of amounts due to the Russian state.

Important considerations for businesses in connection with the proposed rules for the payment of the advertising duty

In light of the increased fiscal and administrative burden on advertising business, we recommend taking immediate action to address the following key aspects:

-

Negotiating with counterparties in the service delivery chain for the distribution of Internet advertising to determine the “rules of play”, i.e. to obtain a clear understanding of how the advertising duty should be calculated and paid in relation to each item of Internet advertising that is distributed.

-

Analysing the list of services provided to identify services that are directly related to the distribution of Internet advertising.

-

Analysing the company’s approach to the positioning of its services in public sources.

-

Analysing types of agreements (service agreement vs agency agreement) and related documents to determine the following aspects:

- which services under the agreement are assessable to the advertising duty;

- which participant in the chain is responsible for paying the advertising duty;

- commercial provisions concerning the liability of participants in the chain for the non-fulfilment of obligations to pay the advertising duty and the payment of damages to other participants in the event that they are penalized by Roskomnadzor for non-payment of the duty.

-

Configuring the company’s internal processes related to actions required on its account on the Roskomnadzor website for the payment of the advertising duty, including timely response to various notifications from Roskomnadzor.

-

Analysing related tax issues that may arise in connection with the need to pay the advertising duty and adapt the company’s approach to doing business, such as the deduction of expenses for the payment of the advertising duty and advertising expenses for profit tax purposes.

The B1 team is ready to provide professional support on all the aspects listed above.

AUTHORS

.jpg)

Natalia Khobrakova

B1 Partner

Tax, Law and Business Support

Contact

.jpg)

Vadim Ilyin

B1 Partner

Tax, Law and Business Support

Contact

.jpg)

Vasilisa Asanova

B1 Senior Manager

Tax, Law and Business Support

Contact

.jpg)

Kristina Naumenko

B1 Assistant Manager

Tax, Law and Business Support

Contact

OTHER PUBLICATIONS

View all.jpg)

The State Duma has passed a law on the ratification of the double taxation treaty between Russia and the UAE in the third reading

On 24 June, the State Duma of the RF passed a law on the ratification of the Double Taxation Treaty between Russia and the UAE ("DTT") in the third reading. Further steps required for the DTT to be ratified include approval by the Federation Council, signature by the President of Russia and official publication.

25.06.2025

Tax Monitoring: changes in AIS "Nalog-3" services

On 2 June 2025 the Federal Tax Service of Russia published both changes to existing AIS “Nalog-3” services and a number of new services for tax monitoring (“TM”) purposes which must be implemented by tax monitoring participants by 02.06.2026.

10.06.2025

.jpg)

Pillar 2: "Second Wind"

The provisions of Federal Law No. 479-FZ of 26.12.2024, which introduced a duty on income received for the provision of Internet advertising services (“the advertising dutyduty”), take effect from 1 April 2025. However, the law does not fully address the mechanisms for the calculation and payment of the advertising duty or for monitoring the correct and timely payment of the duty.

30.05.2025

The advertising duty: detailed calculation and payment rules proposed

The provisions of Federal Law No. 479-FZ of 26.12.2024, which introduced a duty on income received for the provision of Internet advertising services (“the advertising dutyduty”), take effect from 1 April 2025. However, the law does not fully address the mechanisms for the calculation and payment of the advertising duty or for monitoring the correct and timely payment of the duty.

28.03.2025

Advertising charge introduced

The Federation Council of Russia has approved a bill amending Federal Law No. 38-FZ of 13 March 2006 “Concerning Advertising”. The Bill introduces a charge for internet advertising. The new rules are expected to come into force from 1 April 2025.

23.12.2024

(2).png)

New format approved for notifications of controlled transactions

On 20 August 2024 a draft order of the Federal Tax Service on amendments to Order No. MMV-7-13/249@ of the FTS of 07.05.2018 “Concerning Approval of the Form of a Notification of Controlled Transactions…” (“the Draft”) was published on the federal portal of draft laws and regulations.

24.09.2024

Individual permit to export goods in light of retaliatory export restrictions imposed by Russia

Many cross-border traders face the need to ship goods out of the EAEU for a variety of reasons, such as equipment repairs, sales to foreign counterparties, and so on. However, for over two years now Government Decree No. 311 of 09.03.2022 has imposed a ban on the export of a large range of goods (currently over 200 items). That ban is in place until 31 December 2025.

30.08.2024